SECTION OVERVIEW AND POLICIES

This section provides Business Units with instructions on recording and paying retainage against applicable contracts.

There are instances where ongoing contractual services exist between a Business Unit and a vendor, and the Business Unit deems it prudent to retain a certain percentage of contractual payments until such time as it is evident that the goods or services received meet the required criteria.

Process and Document Preparation:

COMPLETING A VOUCHER TO WITHHOLD RETAINAGE

The purchase order (i.e., contract encumbrance) should reflect the total contract liability amount, including the amount that will be withheld from the vendor payment as retainage.

The vendor should invoice for the full amount of goods or services provided, including any amounts that the Business Unit will be withholding as retainage.

When processing the voucher, the Business Unit should refer to the appropriate purchase order in two lines: one to liquidate the full amount of the payment as a charge (positive amount), and a second line to represent the retainage (negative amount). Processing both lines on the payment voucher establishes the retainage against the contract-related purchase order for future payments and identifies the retainage liability for financial reporting purposes.

Business Units must enter one of the following three account codes set up for retainage when both retaining funds as well as releasing those withheld throughout the contract period.

| Account Code | Description |

|---|---|

| 58951 | Used when temporarily withholding funds from contract payment(s). |

| 60321 | Used when temporarily withholding funds from grant payment(s). |

| 60750 | Used when temporarily withholding funds from capital project payment(s). |

For more information on account codes, please see Chapter IV, Section 4.A - Department Operations - Personal Service of this Guide.

A few screen shots are provided below to assist Business Unit officials in understanding the process. Please refer to the Statewide Financial System Program’s training curriculums for full instructions.

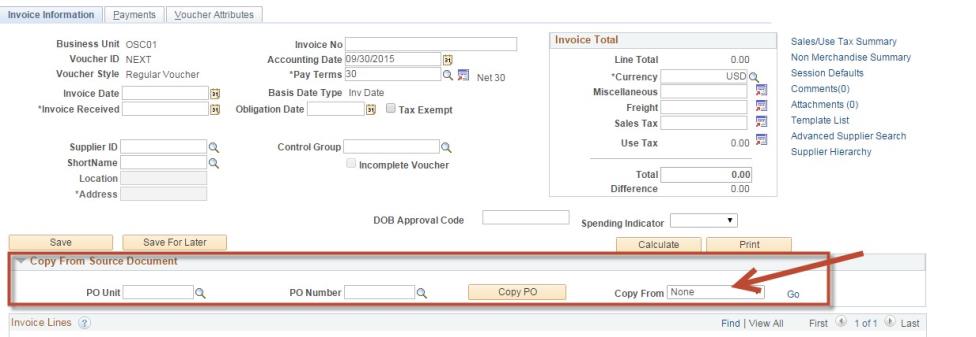

When processing payments from an invoice for a contract payment that will be recording retainage, the Copy From option should be used.

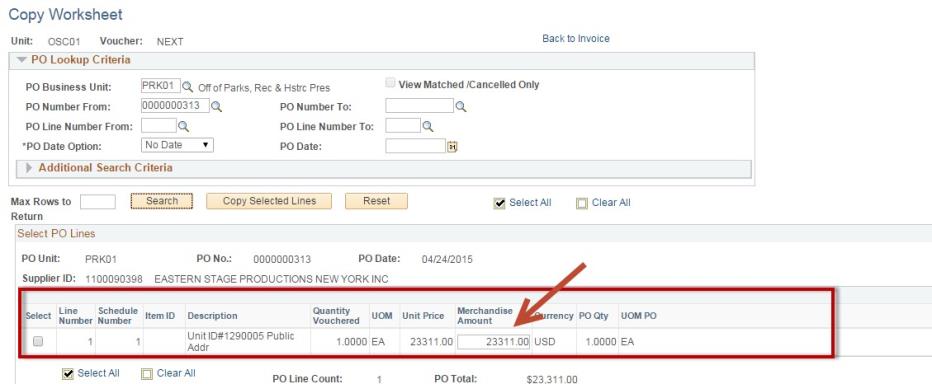

Once the purchase order is copied in, the amount should be adjusted to the full amount of the invoice provided the vendor has billed for the retainage amount as well as non-retained amount.

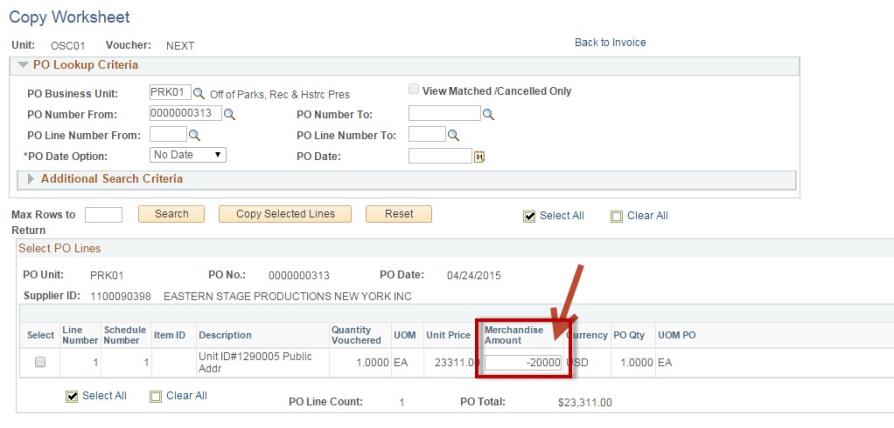

The processor should copy the purchase order into the voucher again for the same line and full amount. The processor should then adjust the line amount to be a negative amount for the total to be retained on the current voucher. In this example, we are holding $20,000 for retainage.

PROCESSING A VOUCHER TO PAY RETAINAGE

When the holding period ends and the Business Unit is paying the retainage that has been withheld against the contract, the processor should again copy from relevant purchase orders using the retainage lines to complete the total payment.

The Business Unit must enter the same account code used when the funds were originally retained in order to release those withheld throughout the contract period.

| Account Code | Description |

|---|---|

| 58951 | Used when temporarily withholding funds from contract payment(s). |

| 60321 | Used when temporarily withholding funds from grant payment(s). |

| 60750 | Used when temporarily withholding funds from capital project payment(s). |

Questions relative to the payment process should be directed to the Bureau of State Expenditures’ Customer Service Help Desk at (518) 474-4868, or by email addressed to [email protected].

Guide to Financial Operations

REV. 10/01/2015