The deterioration of capital assets can weaken the State’s economy and its ability to attract and retain business, while a robust, efficiently managed capital investment program can support economic growth. Capital assets include not only highways and bridges, but also facilities for education, government, health and recreation.

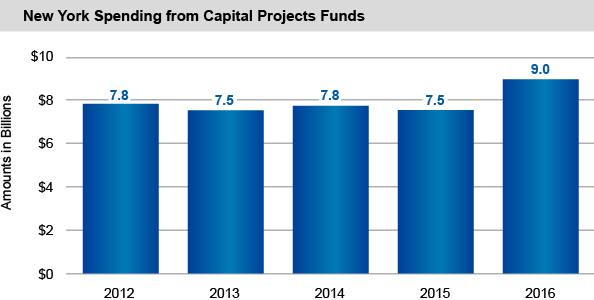

Capital Spending Has Increased Over the Past Five Years

- From 2012 to 2016, capital spending increased overall by nearly $1.2 billion (14.6 percent).

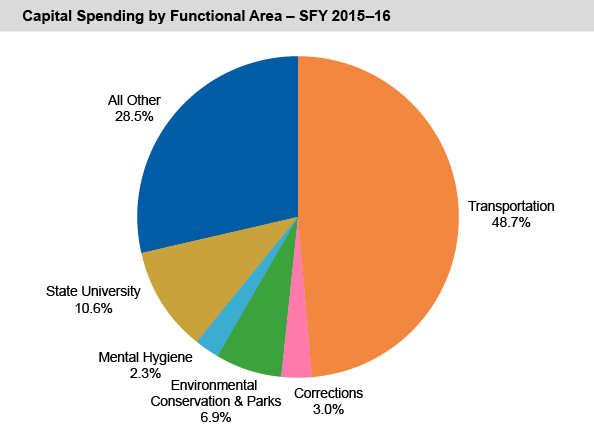

- Capital spending for transportation increased by $823 million (23.2 percent). The increase is primarily attributable to the Consolidated Highway Improvement Program being shifted to an on-budget accounting structure.

- Capital spending for All Other purposes increased by $288 million (12.7 percent).

- In 1994, the State financed 51 percent of nonfederal capital spending through current operations on a pay-as-you-go basis. Between 1995 and 2015 the share financed on a pay-as-you-go basis trended mostly downward, averaging 39 percent. In 2016, the State financed 58 percent of nonfederal capital spending on a pay-as-you-go basis in part by utilizing one-time resources (financial settlements) to fund certain capital projects.

- For the next five years, the State projects:

- capital spending to average $12.7 billion per year; and

- the share of nonfederal capital spending financed on a pay-as-you-go basis to average 36 percent.

At the end of State Fiscal Year 2015-16, the State reported $102.5 billion in capital assets, an increase of $700 million (0.7 percent) from the prior year.