Revenues are affected by economic changes and changes in federal and State policies. Tax base is a measure of the State’s ability to generate revenue. A decreasing tax base may force spending reductions, increased taxes, or both. Receipts are revenues that have been recorded on a cash basis.

See Appendix 3 for a breakdown of State receipts by major source for the past five years.

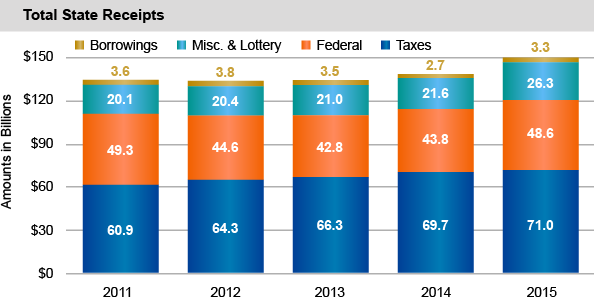

Total State Receipts Have Increased Over the Past Five Years

- From 2011 to 2015:

- total receipts increased 11.5 percent.

- tax receipts increased 16.7 percent.

- federal receipts decreased 1.4 percent. This decrease is primarily related to the winding down of the American Recovery and Reinvestment Act. However, federal funding is again increasing with new:

- disaster assistance for Superstorm Sandy and Hurricane Irene, and

- Medicaid funding under the Affordable Care Act.

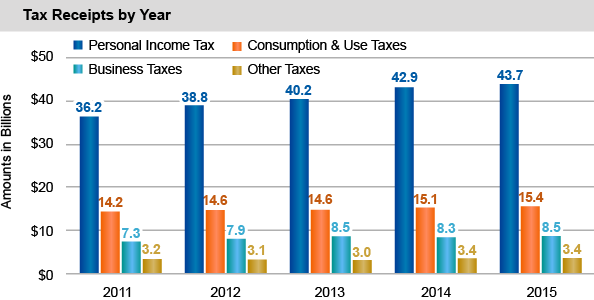

Personal Income Tax and Consumer Tax Receipts Have Increased Over the Past Five Years

- Personal income tax and consumer (consumption and use) taxes:

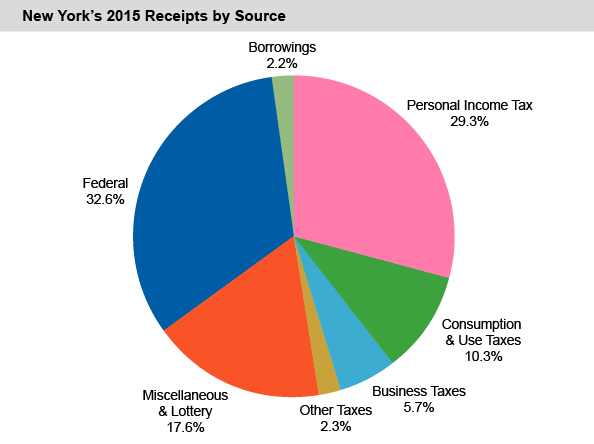

- accounted for 39.6 percent of 2015 receipts; and

- have increased 17.2 percent since 2011.

- In 2015, personal income tax receipts—the State’s largest tax revenue source—increased 1.7 percent.