Purpose

To inform agencies of the changes in PayServ as a result of the application of several software updates

Effective Date(s)

September 27, 2010

Background

On September 27, 2010 the New York State’s PeopleSoft Payroll System (version 8.9) will reflect the application of several tax updates and maintenance patches.In addition to periodically providing new software releases, PeopleSoft also provides six Tax Updates a year to its existing software releases.These updates provide the latest tax information as well as fixes to known software problems. While the functionality of the system remains basically the same, there are minor changes.

Implementation Schedule

PayServ will be unavailable beginning at 12:00 noon on Friday, September 24, 2010.The system will be available as normally scheduled beginning Monday September 27, 2010.

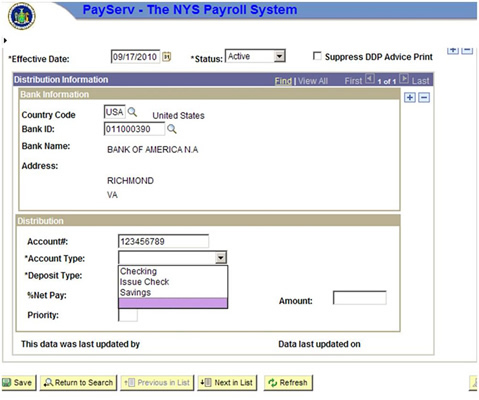

Direct Deposit Page

Changes have been made to the layout and information available on the Direct Deposit page:

The Distribution Information section has been divided into two subsets: Bank Information and Distribution. The Bank Information section contains information about the bank only. The Country Code (USA) and the bank address have been added. The Distribution section contains information about the employee’s account selection. The primary difference is that the Account Type is no longer selected by a radio button, but has a drop down menu offering the three account type options (checking, issue check and savings).

Changes to Non-Resident Alien Tax Rates

Changes have been made to the calculation of federal withholding taxes for nonresident Aliens. IRS Notice 1036 and IRS Publication 15 (2010), which went into effect January 1, 2010, require these modifications.

A new tax table has been established to calculate an amount that is to be added to the regular tax withholding amount. Most nonresident alien employees will experience a tax increase of approximately $15.38 per pay period or $400 per year. Since this new tax rate has been in effect since January 2010, employees may find that they owe taxes at the end of the year. Employees may want to increase their Federal Tax Withholding amount to offset these taxes.

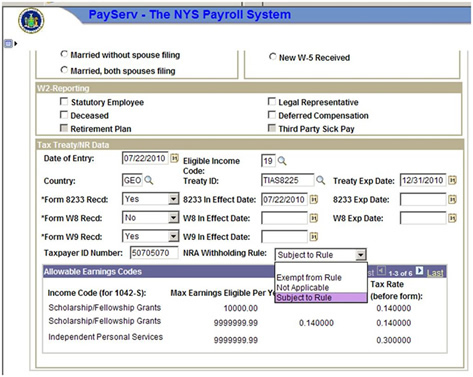

Changes to Federal Tax Data Page

Changes have been made to the Tax Treaty/NR Data section of the Federal Tax Data page. A drop down menu replaces the Y/N check box to indicate if the nonresident alien special tax rules apply.

Generally the standard Federal Tax Withholding formula does not apply to nonresident alien employees. Nonresident alien employees are subject to either special withholding calculation or have a treaty exemption.This calculation and/or treaty exemption is referred to as the NRA Withholding Rule.

Three choices are now available as follows.

- Exempt from Rule - There is exception to this NRA Withholding Rule. Residents of India are exempt from the rule and therefore their taxes are withheld using the standard Federal Withholding Tax method. Exempt from Rule should be selected for these employees. (For agencies using the Automated Interface, the database translates value for this selection is “Y”).

- Non Applicable - In certain cases, nonresident aliens may have income that is no longer subject to the NRA Withholding Rule. This is because they meet the substantial presence test (making them resident aliens for tax purposes) and their income has exceeded the treaty limit or treaty conditions are no longer in effect. For these individuals, the NRA Withholding Rule is not applicable for all or part of their income. Their taxes should be withheld using the standard Federal Withholding method. “Non Applicable” should be selected for these individuals. (For agencies using the Automated Interface, the database translate value for this selection is “R”).

- Subject to Rule - This is the default value. Subject to Rule should be selected for most nonresident aliens. (For agencies using the Automated Interface, the database translate value for this selection is “N”)

As part of the conversion process, employees who have the Y/N check box unchecked will automatically be set to Subject to Rule. Employees who have the Y/N check box checked will automatically be set to Exempt from Rule. No employees will automatically be set to Non Applicable as part of the conversion process. Agencies should update PayServ and select Non Applicable as needed.

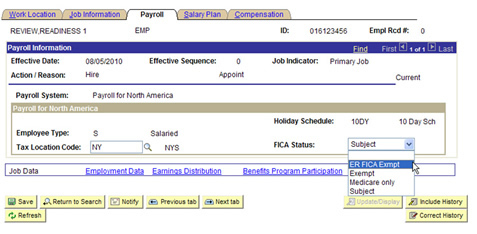

HIRE Act

Changes have been introduced allowing eligible agencies to take advantage of the Hiring Incentives to Restore Employment (HIRE) Act. The Federal government implemented this legislation to provide for an exemption for the employer share of Social Security and Medicare tax when previously unemployed individuals are hired. For Federal, State and Local governments, this exemption applies only to public colleges and universities.

The new value appears on the Payroll tab of the Job Data, Job Requests, and Transfer Requests pages. An additional choice, ER FICA Exmpt, is available on the FICA Status drop down box.(For agencies using the Automated Interface, the database translate value for this selection is “H”). The option is only valid for SUNY and CUNY agencies.

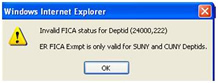

An edit prevents this option from being selected by any non-SUNY or CUNY agencies.

This edit appears on the following pages:

- Hire

- Rehire

- Transfers

- Job Action Request

- Data Chg – Chg FICA Status (CFI)

- New Posn

A full explanation on the implementation of the HIRE Act will be the subject of a separate bulletin issued to SUNY and CUNY agencies only.

Questions

Questions should be directed to the Payroll Upgrade Mailbox at [email protected].