Purpose

To explain the phase-in period, processing changes and revisions to the TIAA/CREF Suspense/NRI page in PayServ

Affected Employees

Employees who are members of the ORP and have the Retirement Plan Type of 7Z (TIAA/CREF) with ten (10) or more years of membership in the ORP

Effective Date(s)

Paychecks dated April 2, 2008 (Administration) and April 10, 2008 (Institution)

Background

Chapter 617 of the Laws of 2007 amends NYS Education Law, Article 8-B, Section 392 2(c) and Article 125-A, Section 6252 2(c), eliminating the mandatory employee contribution for members in the Optional Retirement Program (ORP) who have ten (10) or more years of membership in the ORP. Members of the ORP who have ten (10) or more years of membership will receive a reduction in employee contributions over a phased-in period, ultimately eliminating the employee contribution.

Effective April 1, 2008, affected employees’ contributions will be reduced by 1% and the employer’s contribution will increase by 1%. Subsequent reductions in employee contributions and increases in employer contributions will be implemented on and after April 1, 2009, resulting in the elimination of the employee contributions on and after April 1, 2010.

Effective April 1, 2010, any employee who is a member of the ORP, has an active retirement plan row with a Participation Election of “Elect,” has the Retirement Plan Type of 7Z (TIAA/CREF) and has ten (10) or more years of membership will automatically change to a non-contributory status.

Note: Based on a legal review by OSC Counsel, employees who have ten (10) or more years of membership in the ORP as of April 1, 2008 (those employees with an Election Date prior to April 2, 1998) are eligible for the reduction in contribution regardless of any break(s) in service.

As previously determined by OSC Counsel, a break in service impacts the “continuance in service” provision of section 392(4) of the Education Law, and therefore cannot be included toward the completion of the 366 Day Suspense or 7 year periods.

OSC Actions

OSC will automatically identify employees in Retirement Plan Type 7Z (TIAA/CREF) whose Participation Election is set to “Elect” and calculate the 10 year membership date based on the Election date.

A row will be inserted into the employee’s Retirement Plan record, assigning a new Benefit Plan with the effective date of the pay period begin date in which the 10 year membership date falls.

Note: In order for OSC to chart the employee’s new contribution status as referred to in Chapter 617 of the Laws of 2007, five new benefit plans have been created. The new benefit plans are outlined below.

New Benefit Plans

SUNY/State Education Department

| Current Benefit Plan | New Benefit Plan for Employees with 10 Years of Membership |

| TSYEDB | T6SNYB |

| T3SNYB and T5SNYB | T7SNYB |

CUNY

| Current Benefit Plan | New Benefit Plan for Employees with 10 Years of Membership |

| TCUNYA | T6CNYA |

| TCUNYB | T6CNYB |

| T3CNYB and T5CNYB | T7CNYB |

New Contribution Percentages

Effective April 1, 2008

| New Benefit Plan | Previous Benefit Plan | Rate of Employee Contribution | Rate of Employer Contribution |

| T6SNYB | TSYEDB | 2% | 10% up to $16,500 13% over $16,500 |

| T7SNYB | T3SNYB | 2% | 9% for 7 years 11% after 7 years |

| T7SNYB | T5SNYB | 2% | 9% for 7 years 11% for 7 years |

| T6CNYA | TCUNYA | .5% | 11.5% up to $16,500 14.5% over $16,500 |

| T6CNYB | TCUNYB | .5% | 11.5% up to $16,500 14.5% over $16,500 |

| T7CNYB | T3CNYB | 2% | 9% for 7 years 11% after 7 years |

| T7CNYB | T5CNYB | 2% | 9% for 7 years 11% after 7 years |

Note:The above rates will change effective April 1, 2009 and April 1, 2010 at which time update bulletins will be issued.

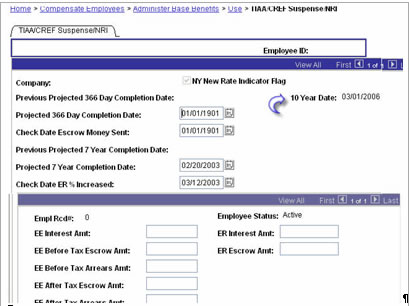

The 10 year membership date will be populated in a new field created on the TIAA/CREF Suspense/NRI page. (In the example below, the employee’s election date is 6/5/1996.) This field cannot be edited, and will update automatically when the Election Date on the Retirement Plans page is entered or changed.

OSC will automatically insert the 10 year membership date for current employees.

Employees newly enrolled in Retirement Plan Type 7Z (TIAA/CREF) will have the 10 year date automatically populated when the Retirement Plans page has been saved.

Agency Actions

Notify affected employees

Questions

Questions regarding this bulletin may be directed to the Payroll Deductions mailbox.